Beneficial

Simple solutions quickly available at your fingertips. Apply with just one document

Simple solutions quickly available at your fingertips. Apply with just one document

A responsible lending approach with a focus on security. We safeguard your information and provide help in tough spots

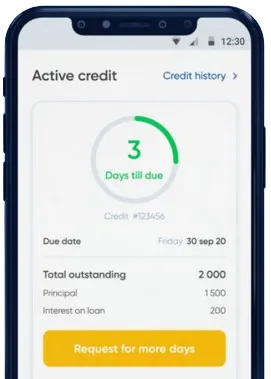

Get fast and simple solutions without stepping out. Instant fund transfers with options to extend loans

Enter your application details in the app by filling out the form.

Hold on for our response, coming in just 15 minutes.

Receive the transfer, usually completed within one minute.

Enter your application details in the app by filling out the form.

Download loan app

Instant loans have become a popular financial solution for many Kenyans in need of quick cash. These loans offer a range of benefits that make them a convenient and useful option for individuals facing unexpected expenses or financial emergencies. In this article, we will delve into the advantages of instant loans in Kenya and how they can benefit borrowers in various situations.

One of the main advantages of instant loans in Kenya is the quick approval process. Unlike traditional loans that can take weeks to process, instant loans are typically approved within hours or even minutes. This fast approval time makes them an ideal option for individuals who need immediate access to funds to cover urgent expenses such as medical bills, car repairs, or utility payments.

Another benefit of instant loans in Kenya is the flexibility they offer in terms of loan terms and conditions. Borrowers can choose loan amounts, repayment periods, and interest rates that suit their financial situations and needs. This flexibility makes it easier for individuals to find a loan that matches their specific requirements and budget.

Additionally, instant loans in Kenya come with varying repayment options, including weekly, bi-weekly, or monthly installments. This allows borrowers to choose a repayment schedule that aligns with their income and ensures timely repayment without straining their finances.

Instant loans in Kenya provide borrowers with convenient access to funds when they need it most. With many loan providers offering mobile apps and online platforms, borrowers can easily apply for a loan, track their application status, and receive funds directly into their bank accounts without visiting a physical branch.

Overall, instant loans in Kenya offer a range of benefits that make them a valuable financial tool for individuals in need of quick cash. With fast approval processes, flexible terms and conditions, and convenient access to funds, instant loans provide borrowers with a reliable and efficient solution for managing unexpected expenses and emergencies. Consider exploring instant loan options in Kenya to access the financial assistance you need without unnecessary delays or hassles.

Instant loans in Kenya are small, short-term loans that can be approved and disbursed quickly, usually within a few hours or even minutes. These loans are typically offered by mobile loan apps and online lending platforms.

Anyone who is a resident of Kenya, over 18 years old, and has a valid national identification card can apply for instant loans in Kenya. Some lenders may also require applicants to have a mobile phone and a good credit history.

The amount you can borrow with an instant loan in Kenya varies depending on the lender and your creditworthiness. Typically, loan amounts range from as low as Ksh 500 to as high as Ksh 100,000 or more.

Repayment periods for instant loans in Kenya are usually short and can range from a few days to a few months. Some lenders may offer flexible repayment terms, allowing borrowers to choose their preferred repayment period.

Interest rates for instant loans in Kenya can vary widely between lenders. However, they are generally higher than traditional bank loans due to the convenience and speed of disbursement. It is important to compare interest rates from different lenders before applying for an instant loan.

The eligibility criteria for instant loans in Kenya may vary depending on the lender, but common requirements include being a Kenyan resident, having a valid ID card, being over 18 years old, having a mobile phone, and having a good credit history. Some lenders may also require applicants to have a source of income.